Trump Demands 1.5% Interest Rates: A 2025 Fed Showdown

Tramp Demands 1.5% Interest Rates

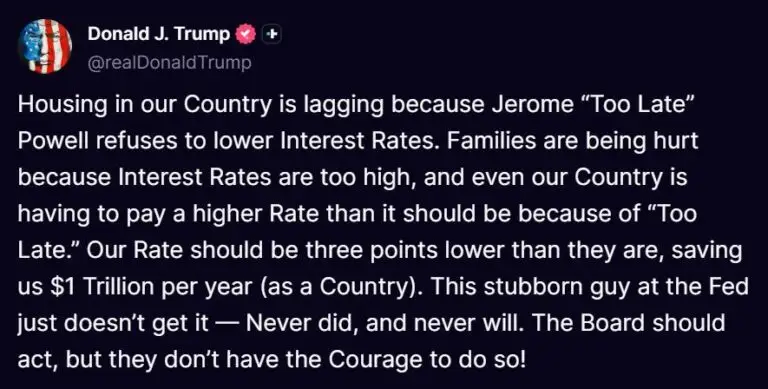

Washington D.C., July 23, 2025 – President Donald Trump has once again intensified his public pressure on the Federal Reserve, reiterating his demand for a drastic reduction in interest rates to a mere 1.5%. This persistent call, primarily voiced through his Truth Social platform, underscores his enduring critique of the central bank’s monetary policy and its chairman, Jerome Powell, even as current economic indicators present a complex picture.

Trump’s latest assertions come as the U.S. economy grapples with nuanced signals. Despite recent Consumer Price Index (CPI) data indicating a rise in inflation, the former president continues to argue that consumer prices are “LOW” and that the Federal Reserve must act “NOW!!!” to lower rates. He has consistently advocated for a three-point cut from the prevailing federal funds rate, which currently hovers between 4.25% and 4.5%. A key rationale presented by Trump for such a move is the potential for massive fiscal savings, claiming it could save the U.S. government “One Trillion Dollars a year” in national debt servicing costs.

The Economic Context and Fed’s Stance

The Federal Reserve operates under a dual mandate: to achieve maximum employment and maintain price stability. This mandate often places it in a delicate position, navigating economic realities while fending off political interference. Economists and financial analysts largely view the Fed’s current cautious approach as a necessary measure to combat inflation, which remains a primary concern. The imposition of tariffs, a hallmark of Trump’s previous administration’s trade policies, is often cited by experts as a factor that could exacerbate inflationary pressures, further complicating the Fed’s decision-making process regarding rate cuts.

Chairman Jerome Powell, whose leadership has frequently been a target of Trump’s criticism, has consistently emphasized the Fed’s commitment to data-driven decisions. While some members of the Federal Open Market Committee (FOMC), such as Governors Christopher Waller and Michelle Bowman, have expressed a willingness to consider rate cuts later this year if economic conditions warrant, the consensus among market observers suggests that the Fed is unlikely to make hasty moves, particularly given the inflation outlook

BREAKING: Trump White House Announcement Today Could Trigger Massive Cryptocurrency Market Shifts

US Holds $24B in Bitcoin While Ethereum Foundation Wallet Sells 7,294 ETH

This Is Massive for ETH: U.S. Spot Ethereum ETFs Hit Record $2.85B Weekly Inflow

For Instant Update Follow my Social Telegram

Free Daily Crypto Newsletter

Market news, price alerts & expert tips straight to your inbox.

Great insights! For players looking to up their game, platforms like Jili777 ph offer AI-driven strategies that could give you a real edge at the virtual table.