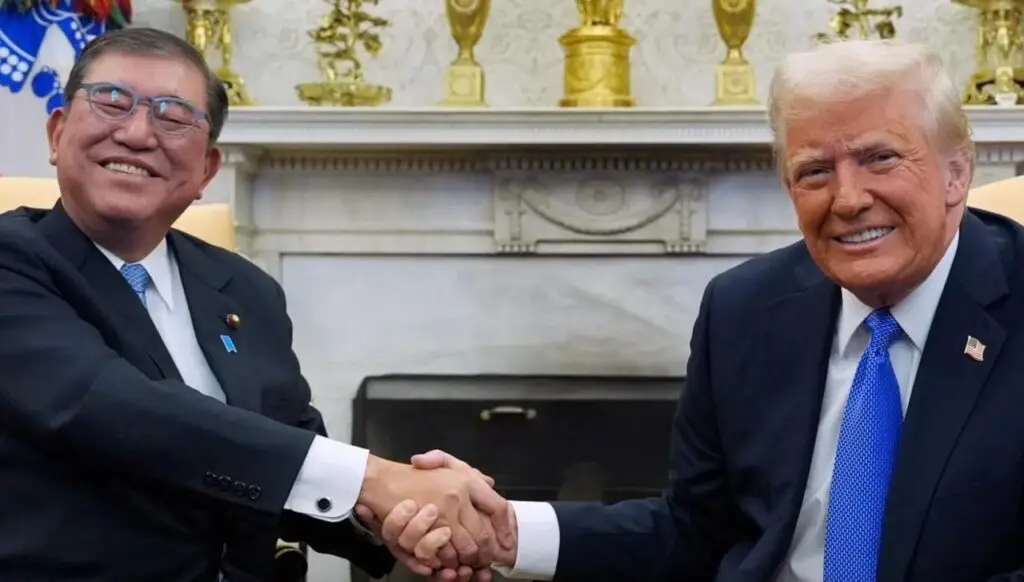

🇺🇸JUST IN: President Trump announces completing "a massive deal with Japan" involving $550B investment Deal With Japan into the US, with America receiving 90% of profits.

Historic Trade Deal $550B investment deal with Japan

A Quick Look at the Announcement

On July 22, 2025, President Trump made a game-changing announcement that sent shockwaves across international markets: a $550 billion investment deal with Japan, paired with a 15% reciprocal tariff agreement. At a press briefing from Washington, D.C., Trump stated that this “massive deal” would bring substantial benefits to the American economy, with the U.S. expected to receive 90% of the profits generated through this investment.

This announcement marked one of the most significant bilateral trade deals in modern American history. While Trump has always positioned himself as a strong negotiator on the global stage, this particular agreement with Japan is being seen as a masterstroke by many of his supporters. It not only reaffirms his “America First” policy but also solidifies the U.S.’s role in leading economic recovery through strategic foreign investment.

Even more importantly, this deal comes ahead of the looming August 1 tariff hike deadline, as part of Trump’s broader push to realign America’s global trade relations. Japan, being a top-five trading partner of the United States, plays a crucial role in this strategy. So when President Trump announced this $550 billion investment and 15% tariff framework with Japan, it wasn’t just about numbers—it was about shifting the power dynamics of international commerce.

Why This Deal Is Making Headlines Worldwide

The sheer size of the deal is enough to dominate headlines. $550 billion isn’t just a figure—it’s nearly double the GDP of countries like Finland or Portugal. This agreement isn’t a theoretical framework, either. According to the White House statement, the deal includes actionable infrastructure investments, tech partnerships, automotive trade incentives, and agriculture market expansions.

On top of that, the profit-sharing clause is perhaps the most headline-grabbing element. With 90% of returns from the investment going to American hands, many experts are calling it a once-in-a-generation economic windfall. Critics, however, argue that the specifics remain murky. Still, the magnitude of this agreement has caught the attention of governments, global markets, economists, and media outlets from Tokyo to Brussels.

The deal’s geopolitical impact cannot be ignored either. With China continuing to exert economic influence in the Indo-Pacific, the U.S.–Japan alliance sends a strong signal of economic and strategic solidarity. Whether you’re an investor, policymaker, or simply a curious citizen, this agreement represents a turning point in how America deals with foreign investment—and how Japan asserts its interests on the global stage.

Breaking Down the $550 Billion Investment

Where Is the Money Coming From?

Let’s unpack that $550 billion figure. According to official reports, the capital comes from a mix of Japanese government-backed development banks, private conglomerates like Toyota and Mitsubishi, and investment arms like the Japan Investment Corporation (JIC). These sources are known for their long-term, strategic capital deployments, especially in technology, energy, and infrastructure.

The investment will reportedly be phased in over a 10-year period, with $150 billion scheduled for disbursement within the first 24 months. Target areas include U.S. transportation systems (high-speed rail and urban transit), clean energy infrastructure, manufacturing plants, and semiconductor production facilities. This isn’t just capital sitting in a vault—it’s a direct injection into projects that could redefine the American economy.

Additionally, Japan sees this as a twofold opportunity: supporting an ally while securing long-term profits. By investing directly in tangible sectors like electric vehicles and chip manufacturing, Japanese companies not only gain a foothold in the U.S. market but also mitigate supply chain risks and tariff exposure back home. It’s smart business—and smart diplomacy.

Which U.S. Sectors Will Benefit Most?

The investment breakdown suggests that the U.S. will experience a surge in job creation and industry development, particularly in the following sectors:

- Automotive and EV Manufacturing:

Factories in states like Michigan, Ohio, and Tennessee are set to receive funding for expansion and electric vehicle R&D. This aligns with Japan’s expertise in hybrid and battery-powered vehicles. - Semiconductors and Microelectronics:

The chip shortage of 2021–2023 highlighted vulnerabilities in the global tech supply chain. With part of the investment directed toward building foundries and research centers, America aims to reclaim semiconductor dominance. - Renewable Energy Projects:

Solar farms, wind energy grids, and green hydrogen plants are top priorities under this deal. Japan brings advanced green tech solutions, and the U.S. brings wide-open land and government incentives. - Logistics and Port Infrastructure:

Upgrades to key ports in California, Texas, and along the East Coast will facilitate smoother trade routes, reduce bottlenecks, and improve supply chain efficiency.

This targeted investment approach ensures that the U.S. not only receives capital but also gains sustainable, high-growth economic benefits. It’s not just a lump sum—it’s a strategic allocation of funds that could shape America’s future industrial landscape.

Investment Timeline and Key Milestones

To avoid overpromising and underdelivering, the deal includes a detailed investment schedule and periodic accountability checks. Here’s how it breaks down:

| Year | Investment Volume | Key Focus Areas |

|---|---|---|

| 2025 | $50 billion | Automotive, Ports |

| 2026 | $100 billion | Semiconductor Plants |

| 2027–2028 | $150 billion | Renewable Energy |

| 2029–2030 | $150 billion | AI & Smart Cities |

| 2031–2035 | $100 billion | Infrastructure Scaling |

The deal also requires both parties to submit annual progress reports to a joint oversight committee. This level of transparency is uncommon in such high-value foreign agreements, which may be why the Japanese parliament has yet to fully ratify the terms.

Still, the early enthusiasm from private sector players on both sides suggests this deal has real momentum. Construction is already underway for two U.S.-Japan co-financed semiconductor plants in Texas and Arizona, with production expected to begin by 2026.

Understanding the 15% Tariff Framework

What the New Tariff Agreement Covers

The second pillar of this agreement is the 15% reciprocal tariff framework. Prior to this deal, Trump had threatened a 25% tariff hike on Japanese autos and electronics—something that could have devastated Japanese exports to the U.S. and provoked retaliation. The new framework avoids this confrontation.

Under the deal:

- Both countries will apply a 15% flat tariff on selected imported goods.

- The U.S. will reduce previous tariffs on Japanese vehicles and electronics.

- In return, Japan will slash tariffs on U.S. agricultural products, including beef, soybeans, and rice.

- The agreement covers nearly $200 billion in annual trade between the two nations.

This balanced tariff agreement is designed to be mutually beneficial while incentivizing fair competition. While protectionist in tone, it avoids the more damaging aspects of traditional trade wars.

Impact on American and Japanese Exporters

For American farmers and manufacturers, the reduction in Japanese import duties is a big win. Beef exports are expected to increase by 40% over the next two years. Meanwhile, carmakers like Ford and GM can now compete more aggressively in Japan, historically a tough market to crack due to non-tariff barriers.

On the flip side, Japanese companies are relieved that a full-blown trade war was avoided. By accepting a standardized 15% tariff across categories, they gain predictability—an invaluable asset in global trade.

Analysts believe this framework will boost bilateral trade by up to 25% over five years. And since it avoids product-by-product negotiations, the simplicity of the flat rate could serve as a template for future U.S. trade deals.

Comparison With Previous Trade Tariffs

Under the Trump administration, tariff policies have been a rollercoaster. From steel to solar panels, different industries have seen varying duties imposed and withdrawn. This 15% deal stands out because it’s reciprocal, consistent, and clearly structured.

By comparison:

| Previous Tariff Type | Average Rate | Drawbacks |

|---|---|---|

| Trump-China Tariffs (2018) | 25%–30% | Trade war, higher prices |

| Steel/Aluminum (2019) | 10%–25% | Retaliation from allies |

| EU Digital Taxes (threatened) | Up to 25% | Legal battles at WTO |

| Japan Tariff Deal (2025) | 15% flat | Clear, reciprocal, structured |

This deal could become a model for future tariff arrangements—straightforward and bilateral, yet flexible enough to adjust over time.

BREAKING: Trump White House Announcement Today Could Trigger Massive Cryptocurrency Market Shifts

US Holds $24B in Bitcoin While Ethereum Foundation Wallet Sells 7,294 ETH

This Is Massive for ETH: U.S. Spot Ethereum ETFs Hit Record $2.85B Weekly Inflow

For Instant Update Follow my Social Telegram

Free Daily Crypto Newsletter

Market news, price alerts & expert tips straight to your inbox.

Interesting read! Understanding variance is key in any game of chance, and platforms like jljl13 download seem to embrace that with their diverse offerings. A legit site focusing on the Filipino player is a smart move too.