US Holds $24B in Bitcoin While Ethereum Foundation Wallet Sells 7,294 ETH

US Holds $24B in Bitcoin

The latest crypto market news reveals that the US holds Bitcoin worth over $24B, cementing its position as one of the largest BTC holders globally. These US Bitcoin reserves primarily come from confiscated digital assets tied to fraud, darknet markets, and criminal cases.

Instead of liquidating immediately, the government has been strategically holding BTC. This long-term approach has effectively transformed the United States into an institutional crypto adoption case study. It also sparks debate: is the U.S. treating Bitcoin as a digital gold reserve similar to traditional holdings?

The fact that the US holds Bitcoin at such scale reinforces BTC’s legitimacy in the global financial system. For investors, this represents a confidence boost, proving that Bitcoin holdings are not just for corporations like Tesla and MicroStrategy but also for governments.

Why US Bitcoin Holdings Matter for the Market

The presence of US Bitcoin reserves valued at $24B has major implications:

Market Impact – A large-scale BTC liquidation by the U.S. could trigger price volatility, while continued holding strengthens the bullish narrative.

Policy Direction – By retaining BTC, regulators may be signaling recognition of Bitcoin as a valuable asset.

Global Perception – The revelation that the US holds Bitcoin adds weight to BTC’s role as a strategic financial instrument.

For crypto enthusiasts, this is a huge piece of Bitcoin news that highlights the growing overlap between digital assets and national-level finance.

Ethereum Foundation Wallet Executes Major ETH Sale

While Bitcoin is making headlines for its reserves, Ethereum has its own story. A wallet linked to the Ethereum Foundation recently made a significant ETH sale, offloading 7,294 ETH.

This particular Ethereum Foundation wallet is closely tracked by analysts because its movements can influence market sentiment. Back in 2022, the same wallet bought 33,678 ETH at $1,193 each. By selling part of those holdings now, the Foundation is likely realizing profits and rebalancing its treasury.

Such ETH sales are common for foundations that support blockchain development. Funds may be redirected into research, grants, or ecosystem growth. However, traders often monitor these moves carefully since they can temporarily impact price dynamics.

Ethereum Price Prediction After Foundation’s ETH Sale

Naturally, the Ethereum Foundation’s move has stirred discussions around Ethereum price prediction. Some analysts argue that large ETH sales may put short-term pressure on the market, hinting at possible corrections.

Others believe this sale does not change Ethereum’s long-term outlook. ETH investment remains strong due to its dominance in smart contracts, decentralized finance, NFTs, and Web3. Institutional interest in ETH continues to grow, further reinforcing the case for institutional crypto adoption.

The Ethereum Foundation wallet selling ETH could be interpreted less as bearish sentiment and more as responsible treasury management. By diversifying and securing funds during price strength, the Foundation is ensuring sustainability.

Bitcoin News vs. Ethereum Developments: What Investors Should Watch

Together, these stories paint a fascinating picture of today’s crypto market news:

On one side, the US holds Bitcoin with reserves now exceeding $24B, strengthening BTC’s status as a macro-level financial asset.

On the other side, the Ethereum Foundation wallet executes a significant ETH sale, showing that Ethereum remains an actively managed and strategically used blockchain asset.

Both events point toward a broader trend—institutional crypto adoption is accelerating. Governments, corporations, and foundations are all playing active roles in shaping Bitcoin and Ethereum’s future.

For investors, this reinforces the case for diversification between BTC and ETH. Bitcoin holdings offer stability and recognition as digital gold, while ETH investment provides exposure to the innovation-driven side of blockchain technology.

Final Thoughts

This week’s updates show why keeping track of Bitcoin news and Ethereum market movements is crucial. The fact that the US holds Bitcoin worth $24B highlights BTC’s maturation into a reserve-level asset. Meanwhile, the Ethereum Foundation wallet’s ETH sale demonstrates proactive treasury management and ongoing confidence in ETH’s future.

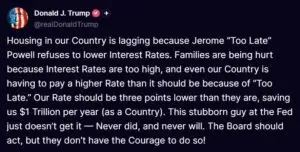

BREAKING: Trump White House Announcement Today Could Trigger Massive Cryptocurrency Market Shifts

US Holds $24B in Bitcoin While Ethereum Foundation Wallet Sells 7,294 ETH

This Is Massive for ETH: U.S. Spot Ethereum ETFs Hit Record $2.85B Weekly Inflow

For Instant Update Follow my Social Telegram

Free Daily Crypto Newsletter

Market news, price alerts & expert tips straight to your inbox.